Day by Jay #10: Seeding the exception

🎨 NFT 📊 The seed-stage exception 🧘♀️ Yogas chitta vritti nirodha

Welcome to “Day by Jay!” A combination of topics I find interesting and enjoyable, I hope you do as well. You can find previous editions here.

🎨NFT

I mined an NFT on Rarible this weekend. A lot more work with a lot less dopamine than posting on Instagram 🤣

📊2020: Flight to Safety and Back Again

This time last year we were in the midst of the worst stock market crash in history. The private markets were no different. Notably, Sequoia published Coronavirus: The Black Swan of 2020.

Sitting at the bottom, few of us would have predicted public and private markets hitting all-time highs less than a year later.

We saw record capital deployed into startups in 2020 and no slowdown in financings.

The seed-stage exception

But the story isn’t that simple. While venture investing across the board was hitting all-time highs, activity was skewed to later stage and follow on financings.

Many of us seed investors felt the pace of deals accelerate. In reality, the number of seed financings hit its lowest since 2016. Capital deployed was down too, but to a lesser extent.

Similar to 2016, the phrase on the tip of everyone’s tongue was “flight to quality.” (Flight to quality meaning more capital into fewer, presumably better, companies.)

Interestingly, these “higher-quality” companies didn't command higher prices.

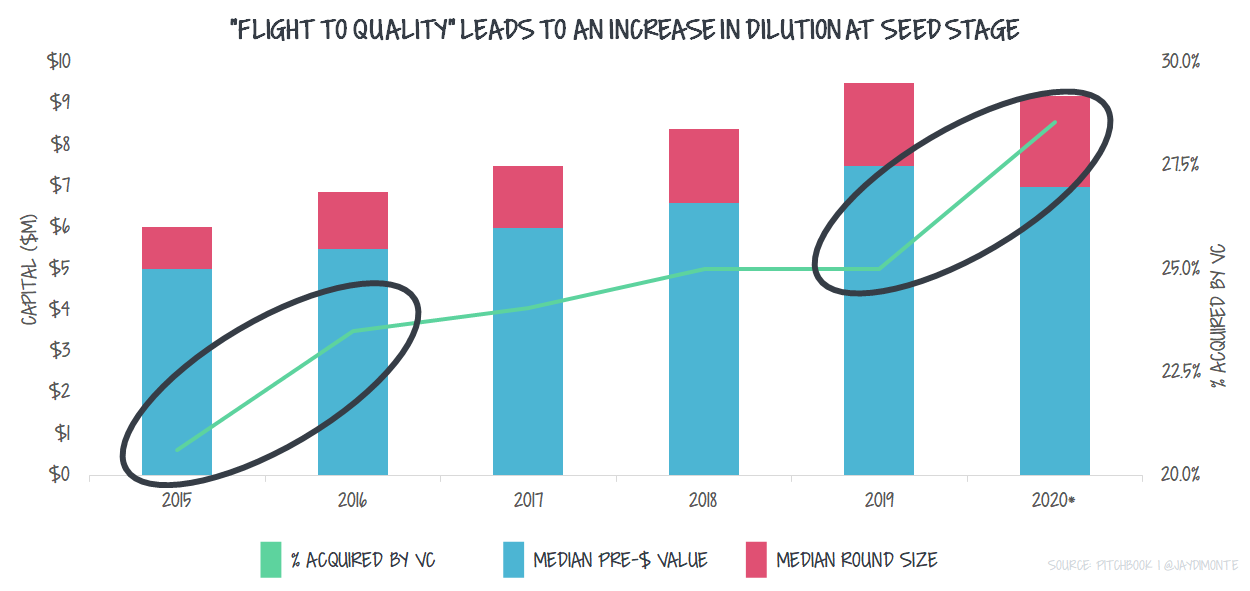

For example, in 2016, round sizes increased by 40% but prices only rose by 10%. Dilution for the median company jumped from approximately 20% to 25% in 2016, where it stuck for the next four years! (Dilution = Round size / (Round size + Pre$ Value))

When COVID-19 hit, round sizes grew by 10% but valuations fell by 7%, different from the trends we saw at the later stage.

Furthermore, we saw this phenomenon hit companies across the spectrum. It wasn’t only COVID-headwind companies that took on extra dilution.

Given what happened in 2016, the question is, “Is this level of dilution here to stay?”

To answer this question, we should look at the factors that drove companies to take on more capital in 2020.

1. Protect the weak

Focus was on the existing portfolio to make sure companies had enough runway to last the pandemic. VCs stopped looking at new investments.

Most VCs spent March and April focused on our portfolio companies. How would COVID impact their business? How much capital did they have? How much did they need?

Financing rounds in Q3 fell into the following categories: (1) bridge financings for companies running out of runway or hit hard by COVID (2) renegotiated or pulled term sheets (3) mature startups pulling in opportunistic capital. Otherwise, if you didn’t have to raise in Q2, you didn’t.

Accordingly, the number of flat or down rounds jumped by 25% in the second quarter. I’m sure there were many notes (debt) issued that don’t count in this number.

2. Be opportunistic

For the forward thinking, the big question was, “Can we get into the hottest deals that we earlier missed (at attractive prices)?” VCs focused on later-stage and growth investments.

A few VCs, especially multi-stage, were opportunistic. Where could we invest in companies that didn't need our capital but were happy to have the extra cushion?

This is where the splashy headlines originated. Many growth funds used March and April to call on companies they “missed” before or hoped to invest at discounted prices.

3. Weather the storm

Founders wanted to raise enough to outlive the pandemic. VCs made sure that they could.

Founders and VCs were on the same page in Q2 and Q3. As there was still uncertainty on vaccines, reopening, and when the fundraising window would close, everyone wanted companies well capitalized for a long runway.

Though round sizes expanded, we saw no similar lift in valuation.

Worth noting, VC fundraising paused for emerging managers in March and April. (We all expected to begin in-person meeting in Q3, so many LP pitches pushed.) Emerging managers are disproportionally present at the seed stage versus other stages. With their own fundraising in question, these VCs grew cautious. For some time, both seed VCs and startups pulled back.

4. Flight to Safety

Uncertainty was all around, with both COVID headwind and tailwind companies experiencing volatility. I wrote about this in April last year, Where did all the VCs go? They went to safer and more attractive assets.

Once the portfolio stabilized, most VCs reemerged by Q3. Sensing an opening, startups flooded the market. Pent-up supply and demand led to feverish fundraising.

The appetite for funding startups had changed. Multi-stage VCs no longer had the risk appetite to place a bunch of option checks on seed-stage companies. Instead, there was a convergence of VCs chasing hot later-stage companies. The focused demand drove prices higher and increased round sizes at the later stage.

5. Ride the wave

Can we keep up? There's a lot of capital to put to work in comparatively few companies. VCs are investing fast and aggressive.

The market has only accelerated. Anecdotally, Q4-Q1 was the busiest I've seen. Many funds worked hard to close deals across the December holidays.

There is no sign of slowing down as our outlook is more positive than ever.

Vaccine announcements and roll-outs provide encouragement for the re-opening of the economy. Personal income increased 10% in January. Markets remain up and support lofty private-market valuations. SPACs are pulling companies into the public market and providing liquidity to private market investors.

What’s next?

Will this optimism and exuberance trickle back down into seed-stage investing? Or, will we continue to see more dilution and fewer financings over the next year?

#1-4 don’t apply much longer but there is still a lot of capital across all financing stages. This supply/demand imbalance will drive the answer to our question.

Short-term: Capital oversupply persists.

The later stage markets will remain heated. This heat will trickle down to seed-stage when (1) seed investors get used to higher revenue multiples in follow-on financing, and (2) multi-stage funds dip back into seed rounds. We may not see this happen within the next 6 months but as the world reopens later this year, I expect seed financings to as well. Valuations likely increase accordingly.

Medium-term: Capital demand bounces back.

New business formation was way up in 2020 versus 2019. If venture-backable startups followed this trend, we'll see an influx of companies fundraising in 1-3 years. (The average seed round closes when a company is 2.5 years old.) Demand for capital will go up.

Supply will hold steady after multi-stage funds have reentered the asset class. (VCs raise new funds every 2-4 years).

We'll see a reversal of 2020's "flight to quality." With prices already rising, startups should expect dilution to fall again.

Net, the next few years will be kinder to seed-stage startups.

🧘♀️yogas chitta vritti nirodha

Sutra 1.2 yogas chitta vritti nirodha

“Yoga is the removal of the fluctuations of the mind”

This maxim of yoga is a reminder to live in the present. When you notice your mind wandering (or your phone buzzing) it is recentering and reconnecting to the here and now.

I bought a pressure washer this weekend. Funny enough, it was a perfect opportunity to be in the present. Too loud for a conversation, too wet for headphones, and too dangerous to forget where the nozzle is pointed. No option but to be fully engaged. Who would have thought I’d find Sutra 1.2 cleaning the patio!

Thanks for reading. Ciao! 👋

Great analysis, enjoyed reading it. I wonder what will come of the opportunistic fundraising / investing in 2020 re: companies that turned out not to "need" it and by Q3 were sitting on more capital than expected. Would be interesting to track in terms of impacts to various trajectories, good and bad, and/or to see what various teams did or didn't with do with it. Very interesting world you operate in (I'm not in VC; just read out of interest).