🎨Celebrate!

Evan and I got married last month!

📊Are creators the new capitalists?

The artist Beeple made history selling an NFT for $69M. Mainstream interest in NFT Art exploded.

Before jumping in, a few notes: If you’re not familiar with NFT basics and their place in culture start here then come back. For the purposes of this blog, we’ll talk about NFTs as digital art or a digital asset that represents physical art. Now back to regularly scheduled programming…

After being non-existent in 2019, NFT Art trading hit $115M in 2020 and has already 7x’d in the first 5 months of 2021.

Even more extreme, consumer interest went from 0 in Q2 2020 to 100 a year later (as measured by Google search volume).

This growth comes with lots of hype, scams, and quick money schemes. It also comes with a paradigm shift in how we think about artists' and other creators' part in the economy.

Traditionally, artists part with their work when it’s sold. Even if they sell prints, those prints are in the hands of the buyer who can display or sell at will. The artist would never know.

When artists mint NFTs, they specify parameters that change this paradigm. For example, an artist can choose to take a percentage of every transaction subsequent to the first. If they sell their NFT for $100 but it later transacts for $1M they could pocket $200K.

This new structure is closing the space between creators, consumers, and capitalists.

NFTs create marketplace fluidity

NFTs combine siloed markets into a single ecosystem. In an analog world, you needed to be in a different place to buy different art. For example, you went to a sidewalk sale to buy local art. Galleries curated art from professionals. Auction houses delt accomplished (and many times dead) artists. The former two consist of primary sales while auction houses specialize in secondaries.

In the “first” digital age, these lines held when we moved online. Etsy and Shopify brought primary sales online. Platforms like Masterworks innovated by fractionalizing ownership of fine art.

NFTs span these categories. You can buy primary or secondary. Art ranges from $5 to $50M. You can buy parts or wholes. One of one or of many.

Naturally, by melding previously siloed transactions and marketplaces, the user-types blend as well.

When I buy an NFT, I am a consumer (I get utility from possessing and enjoying), a capitalist (I expect the asset to appreciate with the intent of selling), and a collector (my name is always part of the piece's history). Because NFT transactions live on the blockchain, our role in the art’s journey is permanent. Put all together, NFTs create a community of fans and owners that buy into the creator's success. We all benefit, gaining utility, status, capital as the piece appreciates.

This merging of identities will resonate in other art types including music — “I discovered X” — or memes where uncredited work goes viral.

Compare this to the traditional sale of physical or traditional art. Once a creator sells, they are out of the equation. Where the art's utility is greater than its intrinsic value, its owner will keep it on their wall. They'll be a consumer but never an investor. Alternatively, some collectors of high-value art may enjoy looking it at too. But, many of them keep their collections private which limits community.

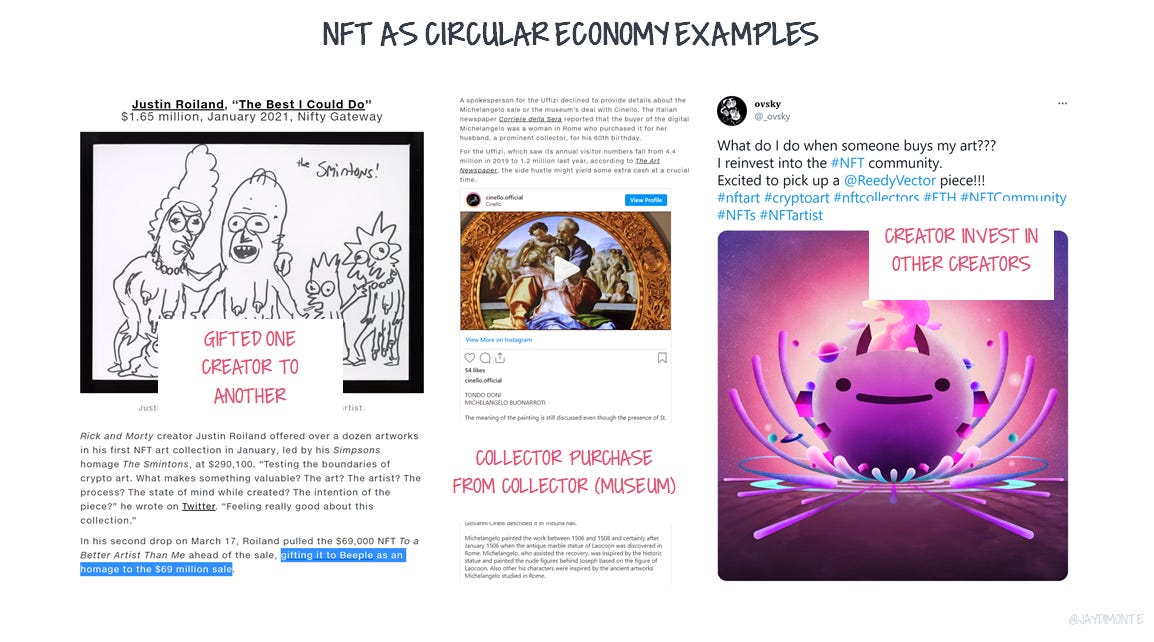

The biggest shift may be in the way artists participate in the marketplace. Now, they easily and quickly transition from buyer to seller, fueling the NFT economy. Creators often gift to other creators out of respect or admiration. They recycle their earnings back into the community, both investing and giving back.

We’re seeing more and more evidence of this circular flow in NFT-land. Buyers sell and sellers buy.

At the beginning of this year, 95% of transactions were primary. Now, 30% of all transactions are secondary.

To put in context, 45% of NFT art would have already gone through a second sale (assuming no pieces of art were sold more than twice).

In this scenario, artists would have generated revenue from the initial sale and royalties from the second sale in a matter of months!

This means creators and artists are getting paid more, faster, and frequently. Whereas in the olden days we referenced "starving artists," NFTs are minting millionaires.

NFTs unlocked demand…

Unfortunately, it’s looking like artists had one chance to cash in.

2021 was a knockout year for NFT art. Recent months? Not so much. Volume diminished since the February and March highs. (This is also when I listed my still unsold NFT.)

Fortunately, we've seen this story before. Like many other newly-created industries, a strong surge of activity uncovered demand.

What we now know: society wants to consume, collect, trade, and invest in art. We value a sense of community. We're driven by status, utility, creativity.

The issue is the marketplace isn't quite ready yet. It's hard to mint or buy an NFT. It's expensive. It's confusing. What do I own?

We need norms and standards and infrastructure. (We may find NFTs aren't even the best solution to meet this demand.)

…But we’ll need infrastructure to serve it

NFT or no, the future will reward the long tail of artists and creators in a new, digitally native way.

In doing so, creators will take more of their work into their own hands. Those publishing on Instagram, YouTube, and TikTok have been doing this for years. Artists that formerly relied on centralized distribution (especially music) will be empowered to pursue their own channels. They will need tools and infrastructure to accomplish their work.

New markets all go through the same evolution. A trend or offering unlocks demand. Demand drives investment in infrastructure that connects supply and demand. Supply proliferates, finding it easy to reach and serve customers. We see over and over again.

In e-commerce, it was Amazon --> Shopify --> D2C brands.

For a digitally native, NFT-driven art economy, we need infrastructure:

Setup and operations — It is difficult to mint an NFT today even for someone who has a working knowledge of crypto. How to choose the best platform?

Financing — It's expensive. (Transaction costs can eat into profits for smaller items especially.) Can I commission an NFT? Can I finance the minting? What other services smooth out artist cash flow?

Acquisition, curation, distribution — For NFTs or any other digital creation to serve as income, someone needs to buy them. How will collectors, investors, and consumers find art? Will there be virtual galleries? Art influencers? Off-platform communities?

Transaction management — Taxes and other legal issues are going to get tricky. Platforms will need to track and manage income, capital gains, and sales tax for each transaction. Will NFT terms be standardized? How will we manage copyrights?

Product integration — Will I be able to display my NFTs on the new ART TVs? Will I carry around my "wallet" and show it off to friends? Will we go back to physical galleries to view our originals? Our digitals? Or will we virtually visit each other’s collections?

It’s early. Digital and cultural infrastructure are nascent but it won’t be soon.

The global art market hovers around $60B. In 2020, 20% of transactions happened online, up from 10% in 2019.

During ONE, a global online auction organized by Christie’s, a Roy Lichtenstein’s painting was sold for more than 46 million U.S. dollars, making it the most expensive lot sold by Christie’s in 2020. 2021 also looks to be an important year for online art sales, with non-fungible tokens (NFTs) and crypto art hitting the news when a digital collage by American artist Beeple was sold in an online-only auction by Christie’s for 69.3 million U.S. dollars. [Statista]

Over the last year, we have seen an online auction break in-person auction records. Months later, we saw an NFT auction break both of those records.

Even so, this volume and these values pale in comparison to what could be. A digitally native market could increase both the supply and prices of art. The global art market (not to mention other creative markets like music, memes, jokes, fashion, etc.) would erupt with enhanced infrastructure.

What will tomorrow’s infrastructure look like and who will build it?

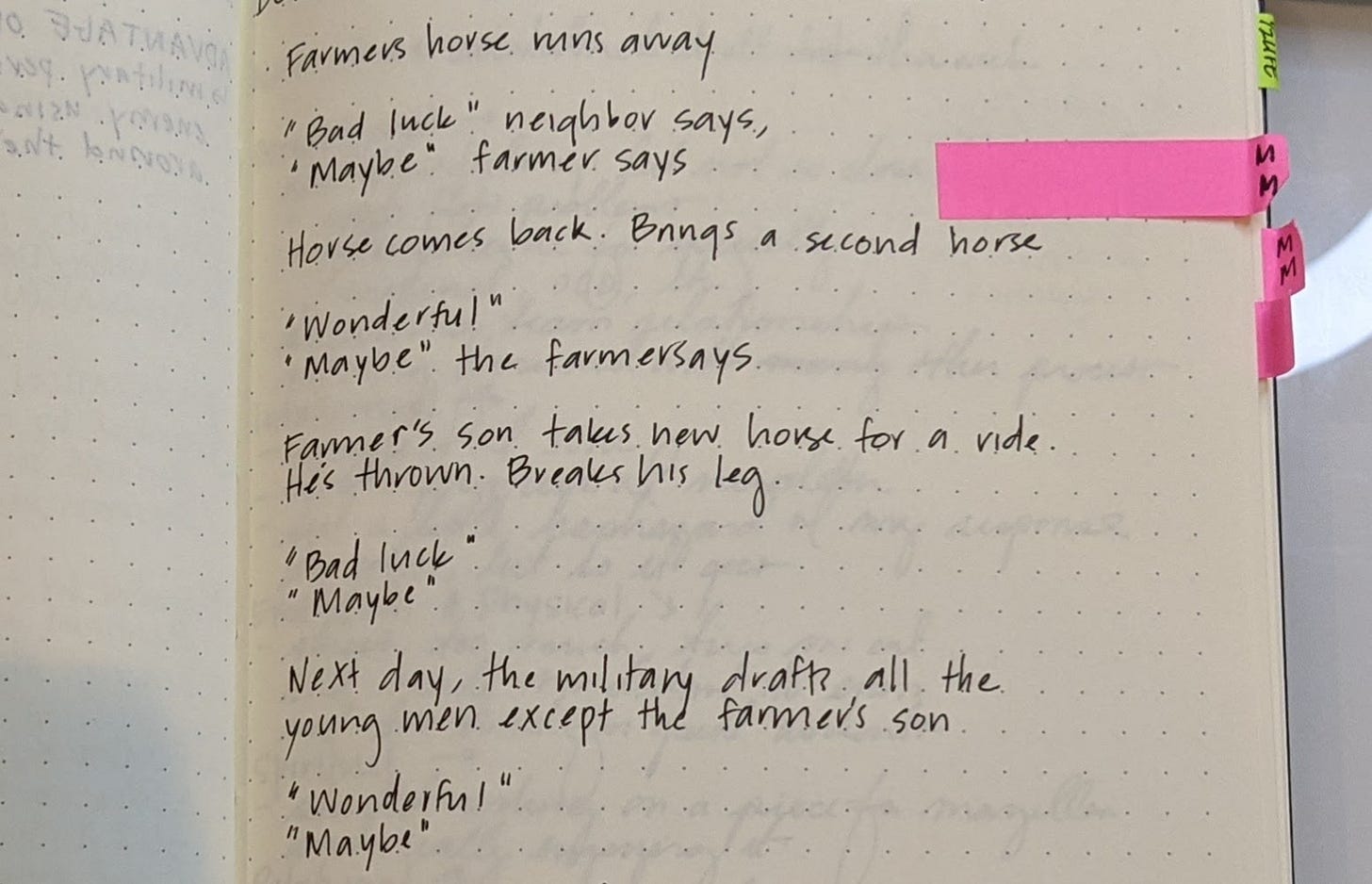

🧘♀️Maybe

Ciao! 👋