What happens when you over-index on momentum early

VCs should be cautious when considering early traction across front- middle- and back- office technology platforms

Months into starting my career in venture, I saw a high-performing company implode. This company was well beyond the typical "implosion" stage (aka pre-seed). Instead, it had raised an early growth round and had tens of millions in revenue. Performance didn't wreck the company. Instead, a black-swan event did.

We saw examples of this type of implosion when COVID hit, and again when it abated.

Momentum builds quickly but it can evaporate so as well.

Sometimes the market stalls out. The economics don’t improve. A team encounters issues. The economy takes a turn.

The best companies avoid or overcome these challenges. They are the best because they overcome. Even great companies succumb.

To this day, that quick reversal of success instilled in me a skepticism of momentum as a signal. All great startups develop momentum. Not all startups with momentum develop into greatness. Which types of momentum can we trust to persist?

Start with the customer

A company’s customer base is a big driver of its momentum, particularly in the early stages. This should be intuitive. The bigger the thing, the more friction, and the harder it is to move. Startups selling to SMBs will land their first customer faster than those selling to enterprises.

This correlation may not persist as startups scale. What does?

We need to take a different look at another driver of momentum… the product's buyer and user. We must look at what motivates any buyer's behavior to understand how quickly they move. Do they get rewarded for taking risks? For finding new platforms and processes? Do they contribute to the growth of the business or do they restrict it?

Revenue-generators (front-office or customer-facing workers) are more likely to experiment. These teams experience nearly unlimited upside with very little downside in their jobs. A salesperson will get recognized (and compensated) for blowing past their quota.

Cost-centers (back-office or support functions) are the opposite. These teams tend to be more risk-averse. Upside doesn't exist in these roles; the best they can do is their work. Downside is virtually unlimited. These teams get recognized when things go wrong but are forgotten when things go right. If your paycheck is correct and comes as planned, you don’t say “thank you.” If it is late or missing, you call HR to complain.

Product-makers sit somewhere in the middle. These are teams that contribute directly to the product.

These motivations are the context for understanding how likely someone is to buy something. If I am rewarded for upside, I will experiment with anything that gives me an edge (and also discard it if it doesn’t). If I only receive attention when things go wrong, I hesitate to adopt new processes, platforms, and ideas.

Revenue-generators adopt quickly

Accordingly, we would expect upside-seeking revenue-generators to experiment with new platforms.

And we do!

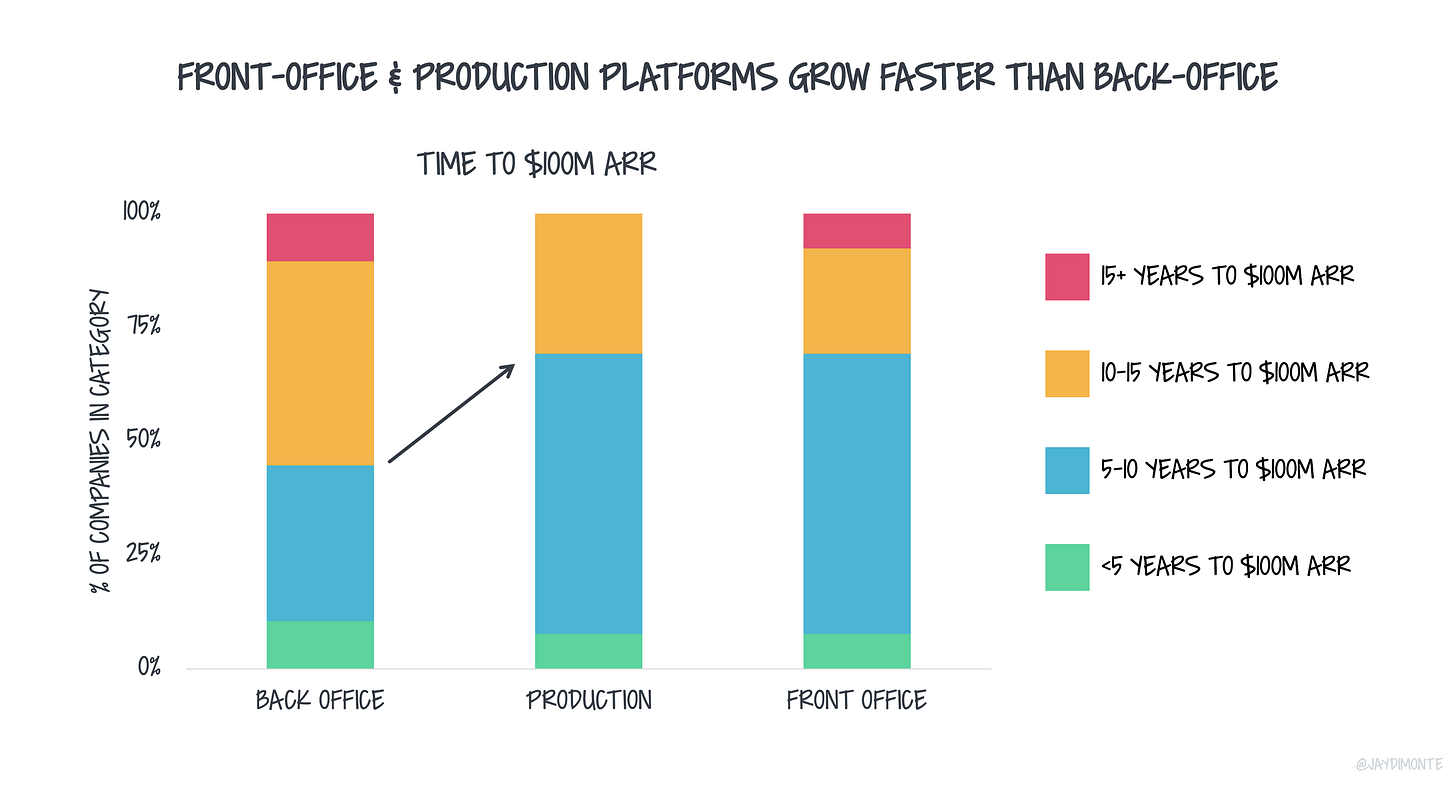

Startups selling to front-office and production teams reach $100M ARR faster on average. ~70% of startups that reached $100M ARR selling into front-office teams did so in less than 10 years versus only ~40% of those selling into the back-office.

Anecdotally, getting to $1M ARR comes quicker to front-office platforms too.

Note that this dataset includes only the most successful startups (reaching $100M ARR) where data is plentiful. I believe the trends would amplify if we looked across all cohorts.

Cost-centers catch up and do so efficiently

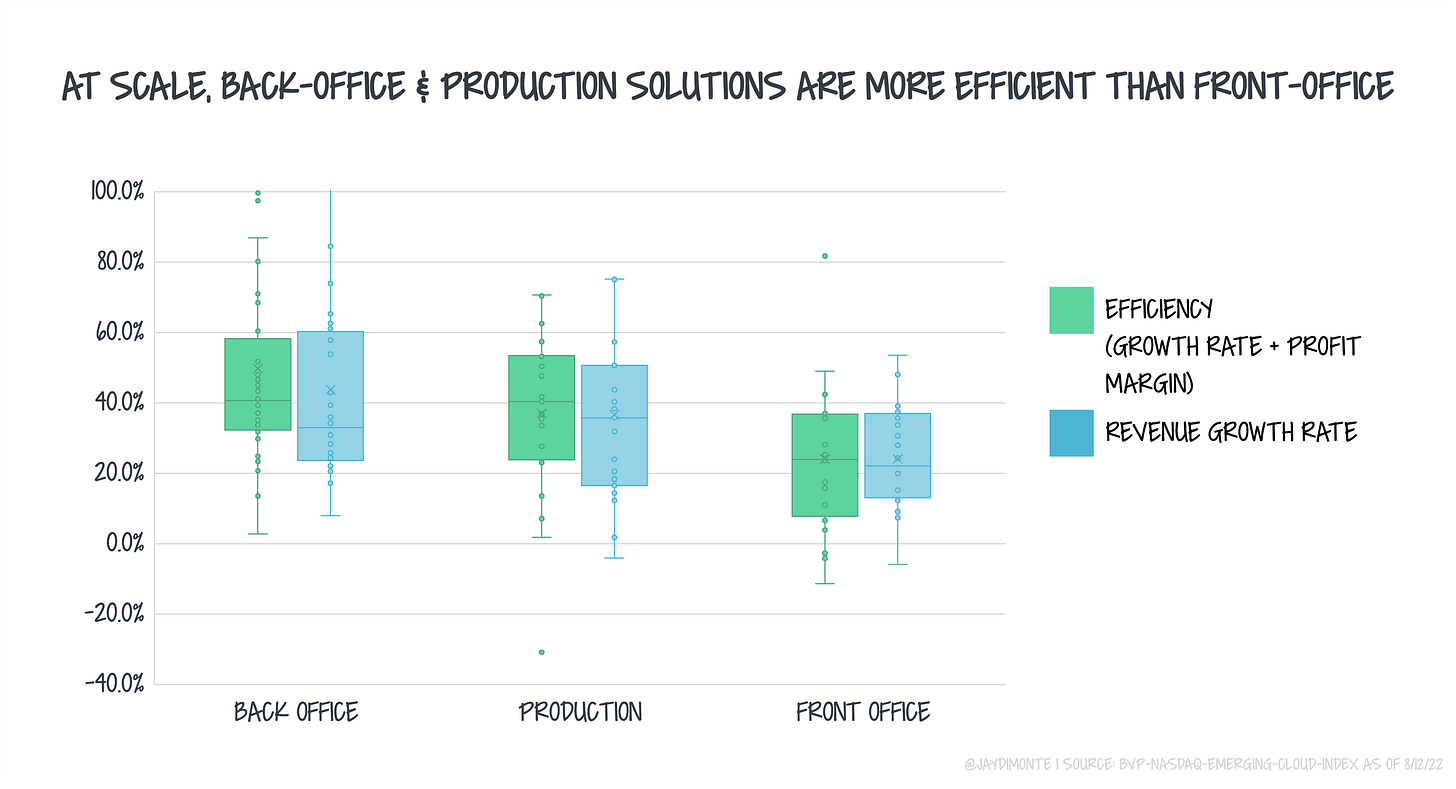

There are two sides to every coin. Front-office startups are quick out of the gate. But, the back-office tends to have more efficient growth over the long term.

Here, we look at "at scale" companies that make up BVP’s Emerging Cloud Index. Those that serve the back office continue to grow faster and in a more efficient way. Their slow-adopting, risk-averse customer base will willingly adopt proven platforms. Now, the risk-aversion of these customers becomes a benefit. Many times, these companies experience higher retention rates.

The market, especially today, rewards these companies.

We apply higher revenue multiples to back-office companies (with growth and efficiency) than others.

Momentum is everything and nothing at the same time: some reminders

Every company in this data set created amazing momentum. They are all successful in their own right.

But, each is unique. Headwinds and tailwinds impact how and when momentum develops. And its persistence from seed to growth to IPO.

For those of us investing at the early stage, it's helpful to remember...

First, while early momentum is important, it is not everything. High-flying front-office platforms may need to burn more to keep momentum up. Under-the-radar startups may encounter risk-averse customers that excel when they earn customers' trust. Namely, back-office and production teams.

Second, growth and efficiency are important. The pendulum often swings between extremes but the best teams prioritize both. Done right, they do not need to be "either/or." Instead, teams pull levers knowingly and grow both over time.

Third, companies selling into product-building teams experience phenomena that cross front- and back-office. Many times, these companies fall into vertical-platform or workflow tools. With the right alignment of incentives, they can be quick out of the gate like front-office startups. Because of their place in core operations and the close communities of customers, they can maintain efficiency over the long term. I am excited for more of these companies to join the ranks of the most successful companies.