You never get a second chance at a first impression

During my business school orientation at Booth, the facilitators split us into teams of a dozen. At the end of the first day, we each filled out “first impression” feedback cards. For each team member, we circled characteristics they presented the first time we interacted. At the end of the weekend, we received a glimpse of the first impressions that we made.

More telling than the traits themselves were what the traits together revealed. Each of the traits represented having or lacking two dimensions: warmth and competence. These dimensions are defined by the Stereotype Content Model.

The model is based on the notion that people are evolutionarily predisposed to first assess a stranger's intent to either harm or help them (warmth dimension) and second to judge the stranger's capacity to act on that perceived intention (competence dimension).

For example, people that lead with warmth (I want to help you) and competence (and I can) are admired. Counterparties seek to align with them.

The purpose of the exercises was self-awareness. How are we perceived by others? How might that influence their initial reaction to us? (Armed with this knowledge, we could excel at job fairs!)

Luckily, first impressions are easy to tweak with interest and a little effort. Moreover, first impressions are only that, first. Over time, true relationships outshine surface-level perceptions.

First impressions are everything for founders

We rarely have time to overcome first impressions when fundraising. Even though the outcome is not transactional, interactions can be. Parties only have 30-minutes to decide whether they want to "continue the conversation."

In the absence of long relationships or track records, VCs often employ heuristics to identify which founders have comprehensive skills. With today’s increased pace and fervor around venture financing, these heuristics become ever more influential. Vice notes in The Great Competition to Give Away Money,

Because of the competitive stakes, investors are “ascribing higher valuations to things where they can move quickly,” which means relying on “hero archetypes,” like established entrepreneurs and management teams that have experience together, Boyd said. “That doesn't mean that they're always the best companies to invest in. They're just easier to diligence.”

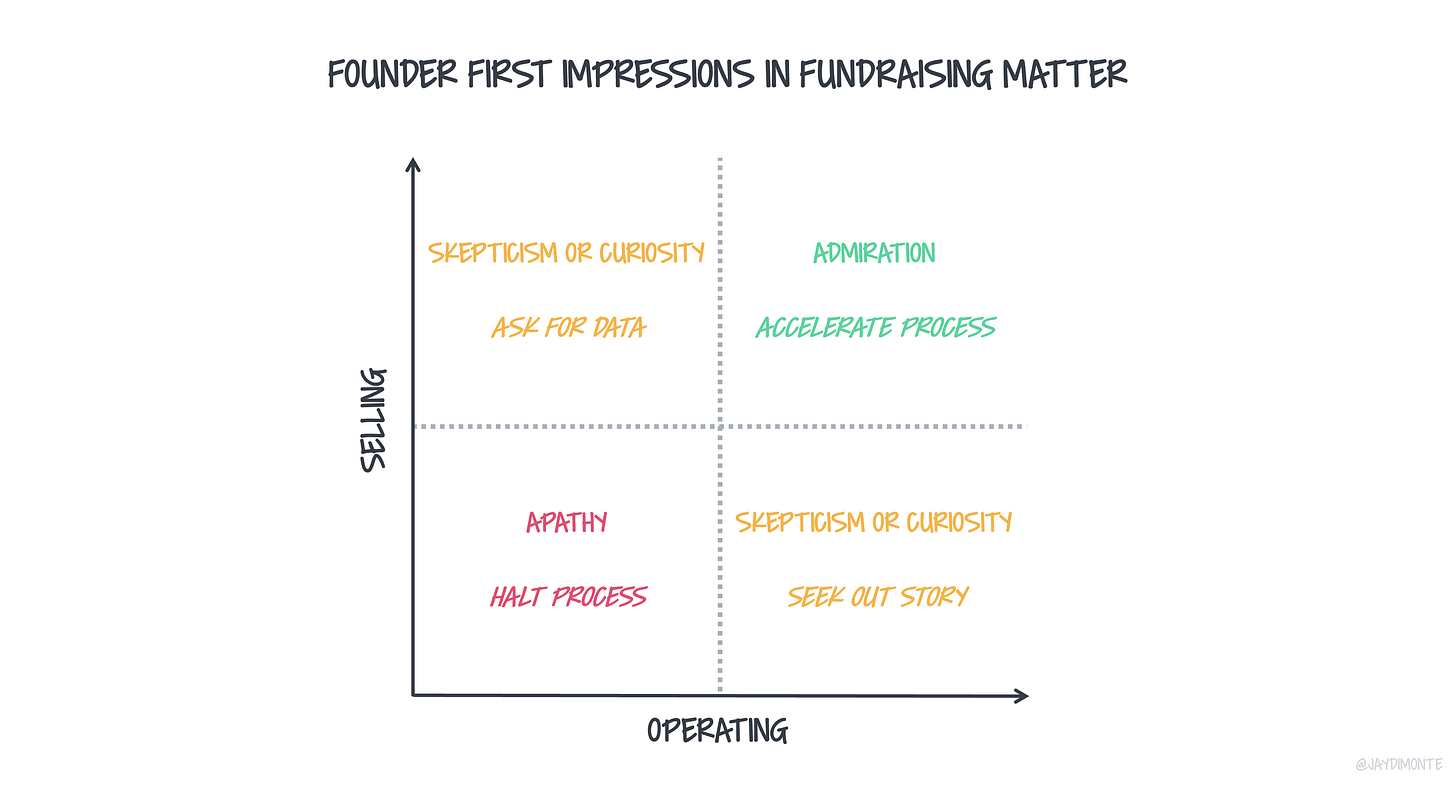

VC heuristics are akin to a modified first impression matrix.

Warmth maps to interpersonal or inter-team interactions. “Do you want to help me?” becomes “Do you seek to solve problems for your customers?”

Competence maps to intrapersonal or team capabilities. “Can you help me?” becomes “Do you know how to build solutions for them?”

These functions describe the activities a founding team must take on.

To simplify, group externally-focused functions into “selling” and internally-focused into “operating.”

Therefore, from our first impression matrix derives a new founder-first impression matrix.

🟩Teams that are strong across selling and operating command a premium in fundraising. Presumably, those teams need less coaching, recruiting, and can move faster.

This is part of the reason second-time founders raise so easily. They have a track record of strength across dimensions. The other part is their track record is longer. It's likely long enough to overcome any negative first impressions.

These are the founders that raise $10M pre-seed rounds!

🟨Many founders lead with sales or operating strengths and at first glance are weaker in the other. For example, some technical founders fall into this category.

The response to these founders will be skepticism (negative) or curiosity (positive). Typically, the difference between skepticism and curiosity is the VC’s background. Do they have experience with your market, your technology, you? An affinity for you or your company may encourage them to seek more. A lack of understanding may cause them to be skeptical and pass.

🟥Some founders don't show strength in fundraising meetings. These are founders that don't get a lot of second meetings. This could be due to an issue of communication (do you need to practice your story? do you have a good handle on your numbers?) or it could be an issue of skill.

VCs can ask themselves the same questions.

I am who I am. Shouldn’t I be myself?

First impressions are in the eye of the beholder but controlled by the beholden-ed.

If the “eye” doesn’t see well, that’s their problem. That said, everyone should put their best foot forward.

One of the most difficult - but important - things is in life is to identify our strengths and weaknesses. The first impressions we make are one element of who we are. Do we make a good first impression? Does that impression represent who we are?

Thus, it is imperative to understand (1) where are my strengths and weaknesses? (2) do I demonstrate my strengths?* (3) can/should I address my weaknesses myself or augment with others? how do I double down on my strengths?

*Yes, it is important to understand how you come across. We are in a war for talent, customers, capital. The pace of combat is increasingly fast. Gain trust and instill confidence and do it the first time!

This all takes introspection and feedback from people that have been close to your work for a long time. Get feedback internally (employees, etc.) and externally (board, investors, etc.). Figure out if you need an advisor or coach, or to hire another leader, etc.

To understand the impression you make, leverage your existing investors. Especially when it comes down to fundraising, you should use them (or other friendlies). One tip, practice with the people from a VC that you don't work with often. They'll have the freshest eyes but are still aligned with you. If you have trouble crafting a story or presenting the metrics, they can help. It'll go a long way in making a great first impression.

As a founder or as a VC, we all have many conversations, each with the potential to be critical. Understanding how you make your “first impression” will be helpful. Not only will it aid in diagnosing feedback and outcomes but a few tweaks could be the difference between a quick “yes” or a long “no.”