What proximity matters most for building vertical startups?

You can't invest in vertical-SaaS without investing in second-tier ecosystems

For most of startup history, the prevailing practice was to move west. That’s where the opportunity, talent, and capital was (is?). In fact, many VCs refused to invest anywhere else… ignoring other startups or predicting their investment on a move to the bay.

For a number of reasons, we no longer operate in that severe of a world.

But, the idea that talent, knowledge, and experience density matter is valid. The question is not “does proximity matter?” but “what proximity matters?”

In second-tier markets1, the answer to this question is more complex. Yes, it includes talent and capital but also customers and exposure to problems. Maybe this exposure enables us to take non-consensus positions before our coastal counterparts.

A perfect example is the many logistics companies that scaled in Chicago, far before logistics was en vogue. Five or ten years ago, many generalist VCs thought (1) logistics was not a big enough software market and (2) even if it was, large software companies would not achieve scale outside the coasts.

And yet, they were. Arguably, they needed to be.

It's not a coincidence that Chicago is home to successful logistics startups... companies like project44, FourKites, and ShipBob. Their founders spun out of local logistics companies. They employ local talent coming from the likes of Coyote, Echo, Arrive, and others.

Conversely, the coast may be better set up to build horizontal software2 because of the resources there.

This is the narrative. Is it true?

We first need to see if there is any difference between vertical3 companies and all others.

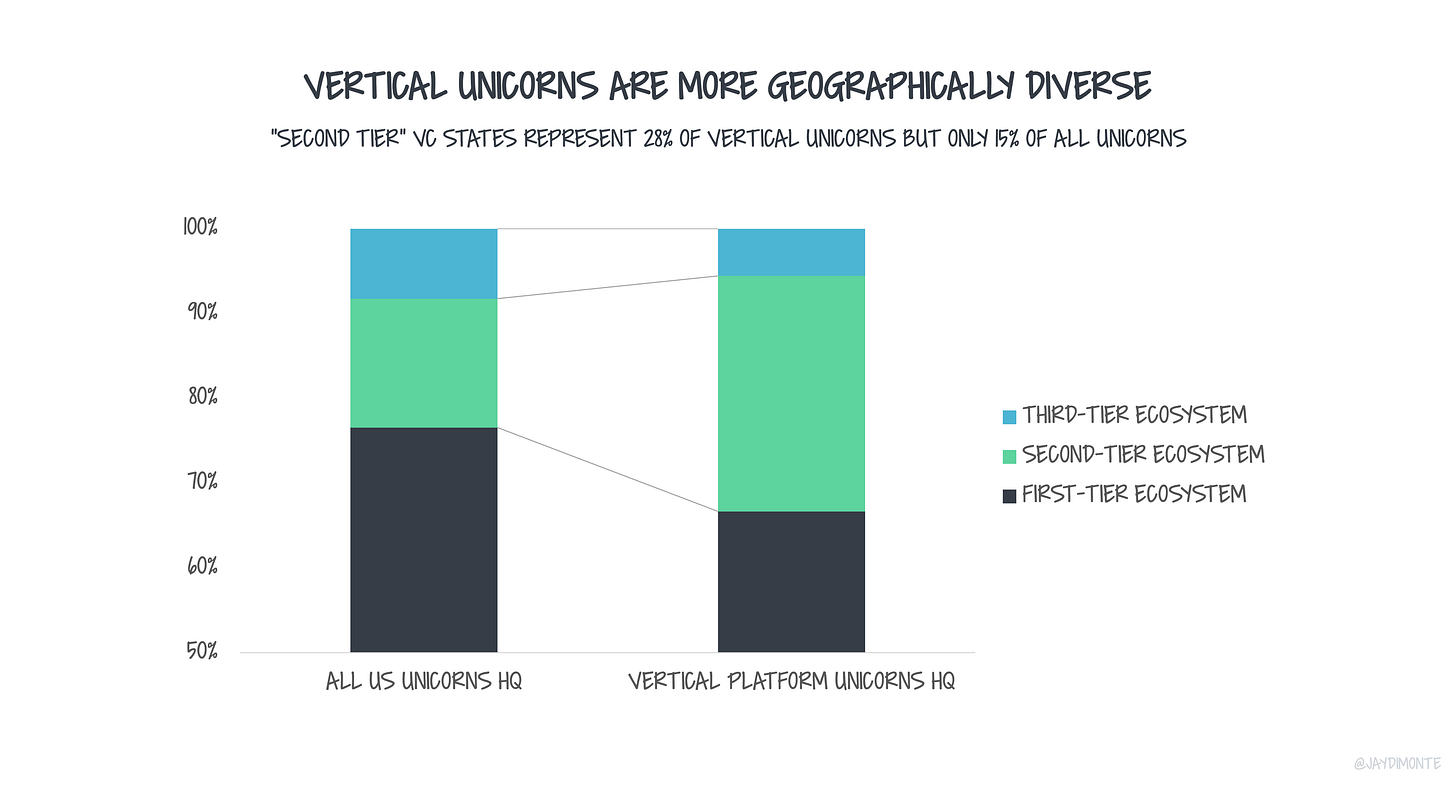

Vertical unicorns are more graphically diverse than horizontal

In fact, there is.

We find a difference between where vertical unicorns4 and others are headquartered.

Second-tier ecosystems produce 15% of all unicorns but almost 30% of vertical-tech unicorns. That’s twice the market share.

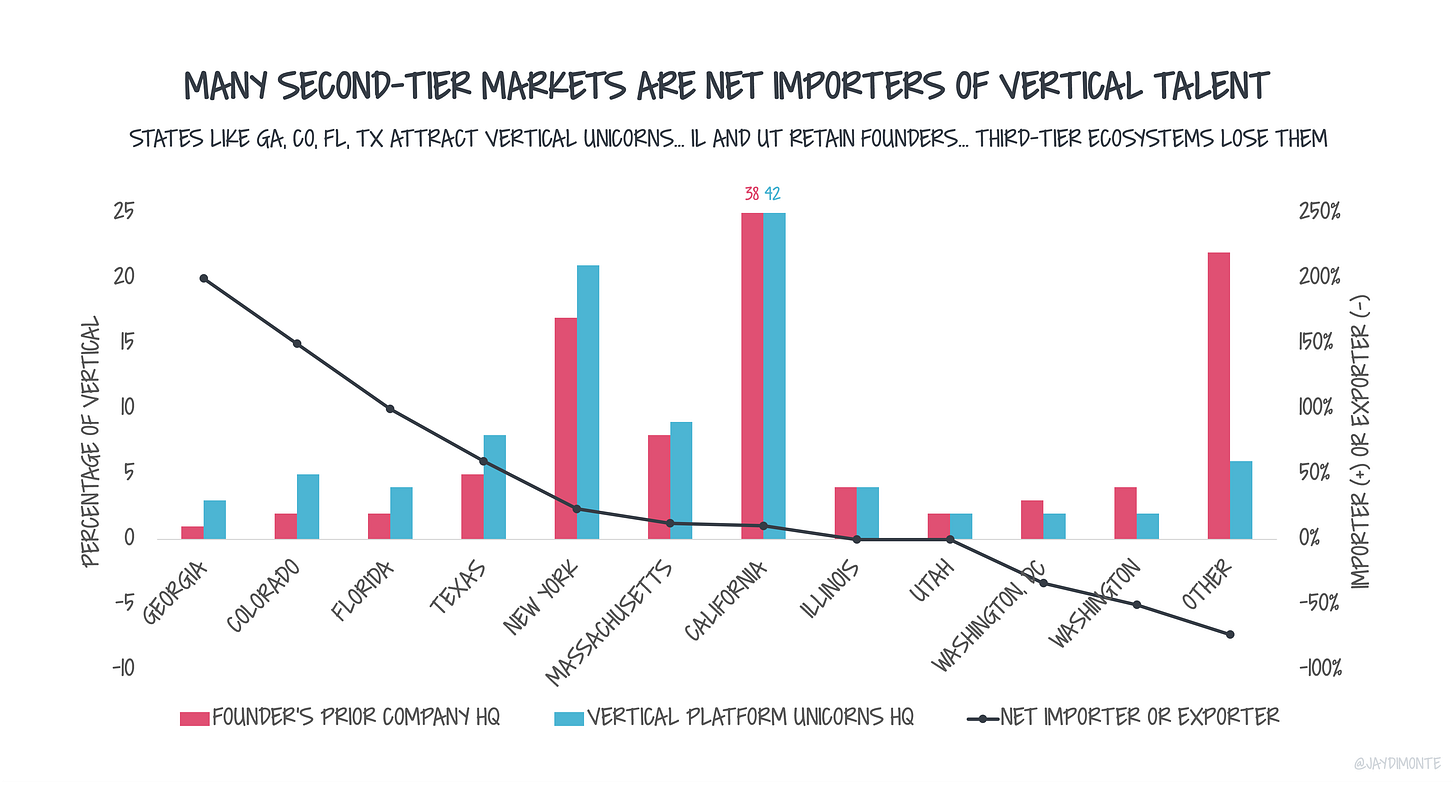

Second-tier ecosystems import vertical founders

Just as many founders move to CA & NY, many vertical founders move to second-tier markets. As a result, second-tier ecosystems became net importers or retainers of vertical founder talent.

The chart below shows this migration. It compares the last place a founder worked to the place they HQ’d their current company.

California has rich pools of talent. 38% of vertical unicorn founders previously worked in CA. Today, 42% of vertical unicorns are HQ’d in CA. This is similar for other first-tier ecosystems. These ecosystems are stable, importing 0-25% of their unicorn talent.

On the other hand, a few second-tier ecosystems experience dramatic rates of vertical founder imports. States like GA, CO, FL, and TX are net importers of vertical unicorn talent at greater rates than first-tier ecosystems. (It’s worth noting that these states also experienced strong population growth.)

Net, top startup markets attract founders.

Third-tier ecosystems export vertical founders

Outflows from third-tier ecosystems make inflows to first- and second-tier ecosystems possible. While 20% of vertical founders come from third-tier ecosystems, only 5% build companies there.

Founders will move to where they have proximity to capital, talent, and customers. Increasingly, that includes more ecosystems but not all.

Talent proximity

Second-tier ecosystems tend to have great university density, a proxy for talent pipelines. This advantage applies to both vertical and horizontal startups.

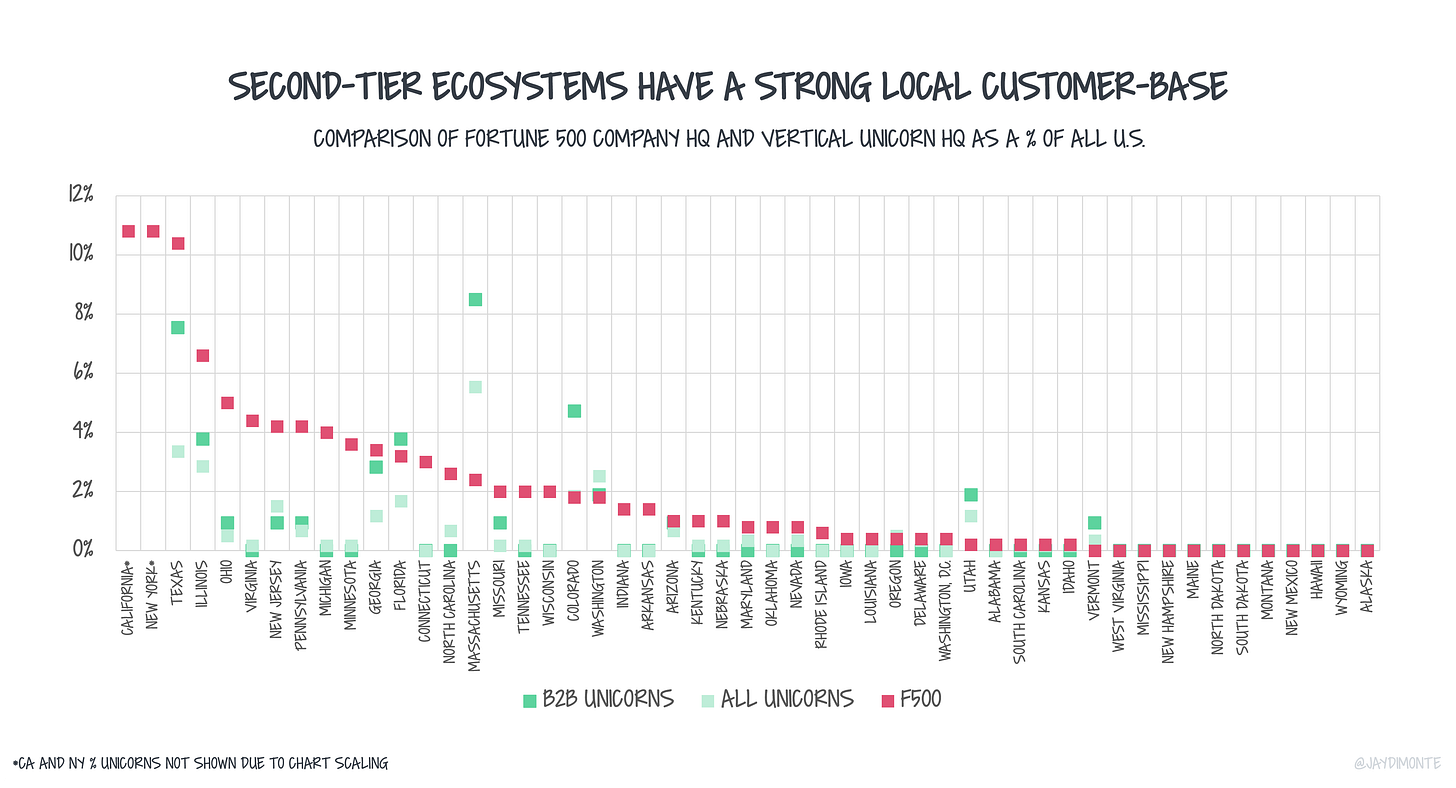

Customer proximity

Second-tier ecosystems also tend to have closer proximity to customers. Below is a comparison of Fortune 500 HQs and unicorn HQs. Possibly a flawed metric, but a simple proxy for enterprise buyers.

Though the correlation is fuzzy, in the negative it is clear. Where ecosystems lack a Fortune500 presence, they also lack unicorns, vertical or otherwise.

Talent and customer proximity make second-tier ecosystems are attractive to vertical founders. Unfortunately, third-tier ecosystems are not branded with these same resources.

For that reason, third-tier ecosystems are net exporters of talent. I expect this to increase the disparity between second- and third-tier cities. Perhaps the narrative of “build anywhere” should be “build where you have an advantage.”

Flywheels in second-tier markets create increasingly stronger forces

Many in the venture world have written about startup ecosystem flywheel, me included.

A flywheel's (or an object moving in a circular motion) power comes from a centripetal force. A centripetal force is one that keeps the object spinning; it directs inwards. The bigger the object, the greater the force. (I also wrote about forces here.)

An ecosystem consists of talent, capital, and customers. The more talent and customers there are in an ecosystem, the more founders it will attract.

Founders will always locate their businesses in strong entrepreneurial markets. Vertical founders overweight proximity to specialized talent and customers… typically found in second-tier ecosystems.

I continue to be bullish onsecond-tier ecosystems. They will increasingly congeal around industry identities where proximity equates to an advantage.

You won't be able to invest in vertical startups without investing in second-tier ecosystems.

A big thank you to Ale Contreras (@ale_contreras__) for helping in this data collection and analysis. We used CBInsights, Crunchbase, and LinkedIn as sources for information on founders and their companies.

First-tier ecosystems - states that produce the greatest volume of startups (vertical and not), including California, New York, Massachusetts

Second-tier ecosystems - the next greatest producers of vertical startups

Third-tier ecosystems - all others

Horizontal - companies whose customers can be identified by function

For some functions that overlap with industries, we ask the question, “how diverse is the company’s customer base?” For example, a company selling to in-house counsel at any enterprise would be considered horizontal. A company selling to legal firms would be vertical. A company selling to in-house counsel at only construction firms would also be vertical.

Vertical - companies whose customers can be identified by industry

Unicorn - company valued at $1B or more, as identified by CBInisghts. We used unicorns as a universal, though admittedly subjective, measuring stick for scale. This dataset begins in 2015.

This is awesome Jackie!

This is awesome Jackie!